Summary

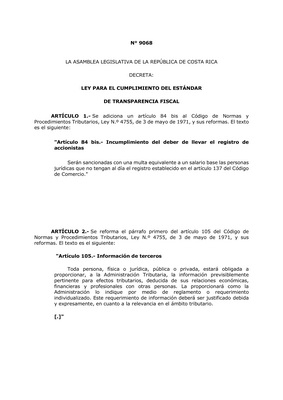

The "Ley para el cumplimiento del Estándar de Transparencia Fiscal N° 9068" was enacted in Costa Rica in 2012. The law aims to comply with the international standard of fiscal transparency, specifically related to the exchange of information for tax purposes. The law imposes obligations on businesses to provide accurate and complete information to the tax authorities, cooperate with tax audits, and maintain accounting records in accordance with the law. The law also provides for penalties and fines for non-compliance with these obligations.

We have sent you the download link, please check your inbox.

Download againSomething went wrong when trying to download this file.

Try again