Summary

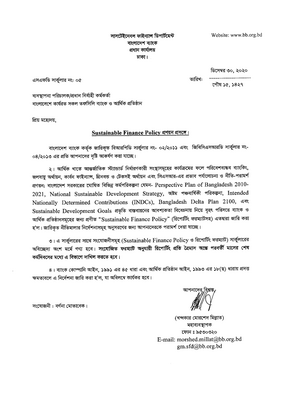

In 2020, Bangladesh introduced a Sustainable Finance Policy for Banks and Financial Institutions aimed at promoting sustainable development in the country. The policy requires banks and financial institutions to integrate environmental, social, and governance (ESG) factors into their lending, investment, and risk management practices. Under the policy, banks and financial institutions are required to establish a sustainable finance unit and a board-level sustainability committee to oversee their sustainable finance activities. They are also required to report on their sustainable finance activities in their annual reports and disclose information on their ESG risks and opportunities. The policy sets out specific targets for banks and financial institutions to achieve, including increasing the percentage of their lending to sustainable sectors, such as renewable energy, and reducing their exposure to high-risk sectors, such as coal mining. Overall, the Sustainable Finance Policy for Banks and Financial Institutions 2020 Bangladesh is a significant step towards promoting sustainable development in the country and aligning the financial sector with national and global sustainability goals.

We have sent you the download link, please check your inbox.

Download againSomething went wrong when trying to download this file.

Try again